Succession planning is the process of preparing your business for a leadership transition when you are ready to leave the company. It refers to the approach and preparation of identifying successors within the business and helping them with the process of developing their skills and experience so they can replace the existing leaders at a future date.

If you are not transferring the business to family or key management staff, you may be looking at a third-party sale. No matter which option you use to secede your business, you will need a plan. The process (often called exit planning) includes a comprehensive approach that factors in the impact to the business owner, their family, employees, and the community.

A business succession plan should consider the exit strategy for the owner along with their personal objectives and financial goals. Your objectives will help you decide which of the ways you want to exit your business:

By transferring to family

By transferring to key management

By selling to a third party

The option you choose will guide the plan you develop. The biggest part of the process is planning ahead to ensure there is time for you to understand the value of your business and take steps to increase the value, if needed, before your exit.

This plan is your roadmap and should be started at least five years before your projected exit date. Getting a written plan in place, even if you adjust along the way, will give you the best possible outcome.

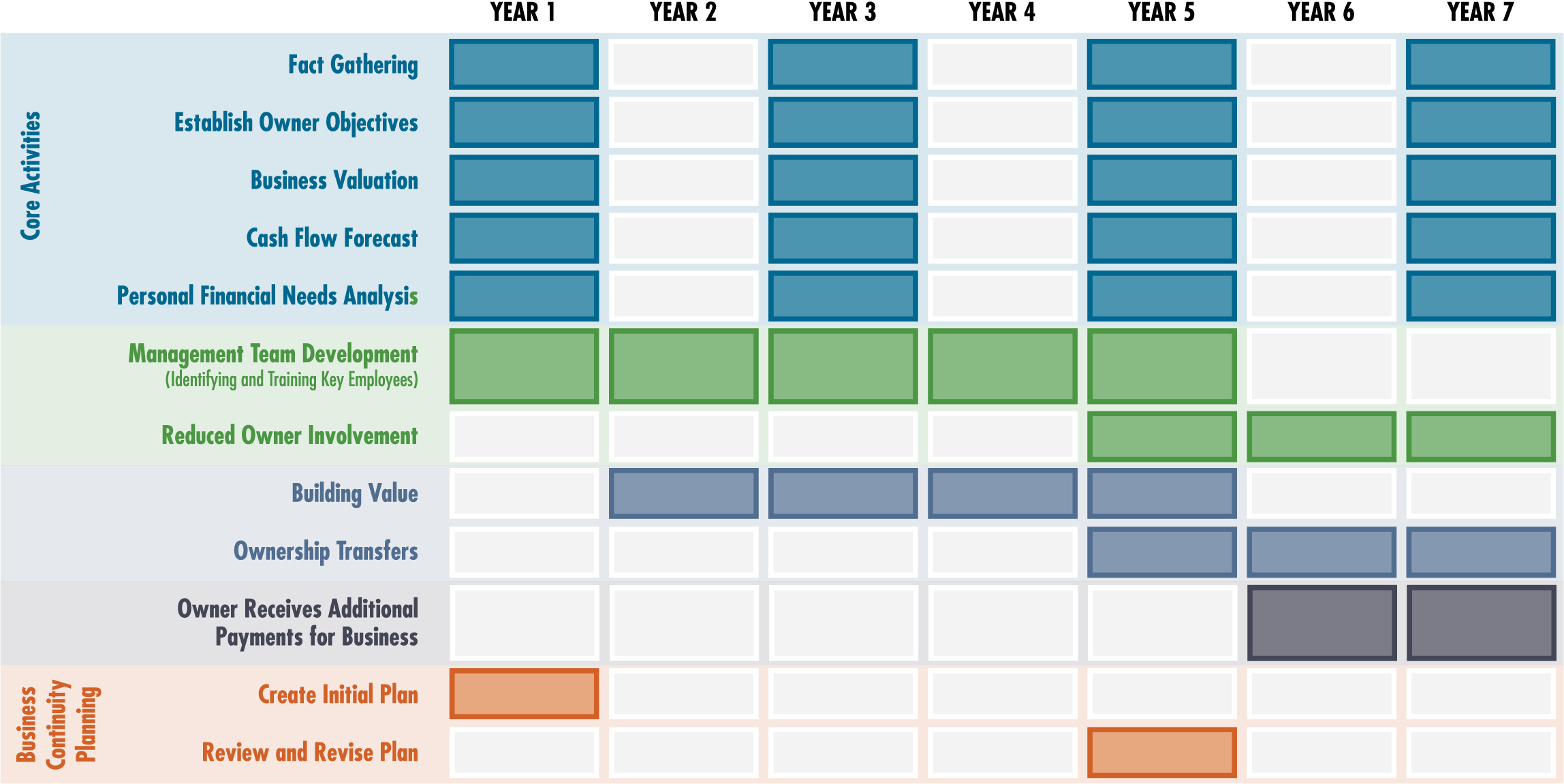

Below is a sample 7-year timeline showing the steps in the exit process. This timeline can be adjusted based on your schedule. The earlier you start, the more successful your transition will be.

The most effective way to create a plan is to gather a team of advisors who understand your business.

The plan needs to include a financial analysis, company valuation, due diligence review, tax planning strategies, and your estate plan development. This is not the time to go it alone. You will benefit from working with a team that has specialized training and experience in the process.

Business professionals need easy access to information to make timely decisions. SVA has what you need, when you need it. Choose a topic below or just contact us directly. Our expertise is ready anytime you need it.

One of the first steps in a successful business succession plan is creating as much value as possible in your business.

This is the time to step back and rely on an advisor to help you look at the aspects of your business and determine where you can improve your value.

Learn about the benefits of the Value Builder System™.

If you are looking to sell to a third party, you will need to follow the four phases of a successful merger. These include Pre-Acquisition Planning, Due Diligence, Deal Negotiation, and Post-Acquisition Strategy.

SVA has experience in all phases of the merger and acquisition process and our certified valuation experts can help make the transaction financially feasible.

ProfitCents is a powerful tool we use to generate projections and perform various “what-if” scenarios. Whether you're budgeting for growth, preparing projections for a loan, or acquiring a business, we use ProfitCents to generate detailed financial forecasts as well as benchmark your company’s performance against industry peers.

There are a number of valuation methodologies that can be used to determine business value. The valuation is a critical component of the process as it is the primary driver for determining how much you will receive for your business.

Our Certified Valuation Analysts have extensive experience to help you with an offer that aligns with the value of your business.

The fact is that every business owner will leave his or her business at some point. But most business owners are so busy doing the things necessary to be successful that they have not taken the time to consider planning ahead for their eventual exit from their business.

Using SVA's customized approach, we will help you look into the future and prepare for the transition out of your business.

The exit planning process has many moving parts. This eguide will provide the information you need to prepare for the successful exit of your business.

This eGuide explains how estate planning is to consider when planning your business exit strategy.

Services

Madison, WI

1221 John Q Hammons Dr, Suite 100

Madison, WI 53717

(608) 831-8181

Milwaukee, WI

18650 W. Corporate Drive, Suite 200

Brookfield, WI 53045

(262) 641-6888

Colorado Springs, CO

10855 Hidden Pool Heights, Suite 340

Colorado Springs, CO 80908

(719) 413-5551

Are you in the know on the latest business trends, tips, strategies, and tax implications? SVA’s Biz Tips are quick reads on timely information sent to you as soon as they are published.

Copyright © 2026 SVA Certified Public Accountants | Privacy Policy | Cookie Policy | CCPA