Published on: Dec 29, 2022 by Daniel Glomski, CPA, ABV, CVA, MST

Updated on: January 30, 2026

| Highlights: |

|

In today’s dynamic market, accurately understanding your business’s true worth has never been more critical, whether you’re contemplating a sale, ownership transfer, or a strategic gift.

A modern valuation goes far beyond historical earnings, offering a forward-looking snapshot that shapes key decisions, from growth planning and succession strategies to tax implications and negotiations.

By harnessing methods like asset-based, income-linked, and market-comparable approaches, you can surface insights into financial health, operational strengths, and industry positioning—all essential for informed decision-making in 2025 and beyond.

There are three approaches to a valuation analysis:

This approach involves valuing a company based on the value of its net assets, which is calculated by subtracting the company's total liabilities from its total assets.

The net asset value is then divided by the number of outstanding shares to determine the net asset value per share.

With the net asset approach, assets held by the business are reviewed and valued, with sensitivity to how much the equipment costs and an appropriate reduction for wear and tear.

The real estate assets are appraised and valued. The goal is to value each asset based on the original cost and reduce it by a percentage for usage and age of the asset. An element of goodwill is factored in, as the "blue sky" costs for intellectual property and customer base can be significant.

This approach is commonly used for valuing companies that have a significant amount of tangible assets, such as real estate or manufacturing companies.

The income approach involves valuing a company based on the present value of its expected future cash flows.

The value of the company is determined by forecasting the company's future cash flows, discounting those cash flows back to the present using a discount rate, and then summing the present value of each cash flow.

This approach assumes the fixed assets and working capital are all contained inside the business and are part of the income approach value.

This is commonly used for valuing companies that generate significant income, such as rental properties or businesses with stable, predictable revenue streams.

This approach involves valuing a company based on the market value of similar companies or assets.

This can be done by comparing the company's financials and performance to similar companies that are publicly traded or have recently been acquired, or by looking at the market value of similar assets that the company owns.

The market approach is the one most people are familiar with as it uses multiples of EBITDA that are based on what businesses have sold recently.

This approach is commonly used for valuing companies with a significant presence in a particular market or industry or with unique assets that are difficult to value using other methods.

A valuation is a forward-looking picture of the value of your business. It is not what the business has done historically, but what the business will do in the future.

Historical data is used to understand the performance of your business to compare it to your peers. Historical data is currently impacted by the pandemic and current economic trends, such as supply chain issues and labor shortages.

All these factors need to be weighed into how historical data will inform a current valuation.

A review of the past five years of financial statements, projections, and forecasts are used to benchmark revenue growth.

Using a list of your largest customers helps the valuation team understand the type of customers you service and their impact on your revenue.

Looking at the financial statements related to gross and net profits helps determine past cash flows. This is used to predict future cash flow.

A review of the customer base related to products and services purchased and profit margins will help determine if the business's margins align with comparable businesses.

The focus is on identifying if the product/service is at peak performance, if it is being rejuvenated, or if it is at the end of its life. Trends and performance of products/services offered give a perspective for future growth.

The owner's compensation typically includes annual salary, life insurance premiums, auto expenses, and a variety of other benefits paid for by the business. An understanding of the total compensation the owner receives is required to compare to industry standards and determine how the compensation impacts the valuation.

If the new owner takes less compensation, then there is a bigger bottom line. If the new owner plans to work in the business and requires a larger compensation package, then that has a negative impact on profits.

The impact compensation has on the sales price is dependent on the type of buyer and their goals regarding working in the business.

Having the right number of skilled employees is more important right now, given the hiring challenges impacting every business.

A review to understand the management structure, how many employees are needed, and if those employees have the skills required is a factor in determining the company's future to meet product demand.

Establishing if there is capacity to grow with the current employee base is often a factor buyers will want to know.

Equipment depreciation schedules are used to determine when new equipment may need to be purchased, if there is obsolete equipment, or if current equipment has significant life expectancy.

If a new buyer will be required to put substantial funds into equipment shortly after buying the business, the valuation number will be impacted.

Conversely, if no large capital assets will be required immediately, the new owner can expect better profitability right from the start.

RELATED CONTENT: BIZ TIP

WILL LEASING EQUIPMENT OR BUYING IT BE MORE TAX EFFICIENT FOR YOUR BUSINESS?

Reviewing third-party rental costs and leases to determine if costs are aligned appropriately is an important part of a valuation.

Will leases need to be renegotiated or are they a good value? What decisions will the new owner need to make sooner, rather than later?

Understanding gross margins and how the cost of sales impacts those margins is imperative. These are compared to industry standards to determine if your suppliers are charging appropriately.

Understanding the strength of the relationships with suppliers and how that impacts your cost models are areas your potential buyer will review.

The valuation expert's goal is to understand your business, competitors, suppliers, and employees, and how strong all of those relationships are.

A normalization adjustment is a modification made to a company's financial statements to more accurately reflect the company's ongoing business operations and financial performance. Normalization adjustments are often made in the process of performing a valuation analysis, particularly when using the income approach.

The purpose of these adjustments is to better reflect the company's sustainable, long-term cash flows, which are used to determine the present value of the company's future cash flows and ultimately its value.

Normalization adjustments can also be used in other valuation approaches, such as the net asset approach, to adjust for differences in accounting practices or to accurately reflect the company's ongoing business operations.

RELATED CONTENT: BIZ TIP

LEARN HOW COMMON NORMALIZING ADJUSTMENTS ARE HANDLED IN FINANCIAL DUE DILIGENCE

For example, if you recently purchased a new computer system with significant consulting time, your professional services costs were higher than they would normally be. Valuing the business without accounting for that would show expenses higher than they would be in the future.

If you had a significant inventory write-off for defective merchandise in the past, that might not occur in the future, so adjustments need to be made to reflect that impact on the bottom line. Understanding the difference between "Rule of Thumb" and a "Valuation Analysis" is important.

A valuation analyzes the positive and negative elements of a company and puts a value on the business using those considerations. It adds credibility and substance and is much more than just assigning a number for what you want for the business.

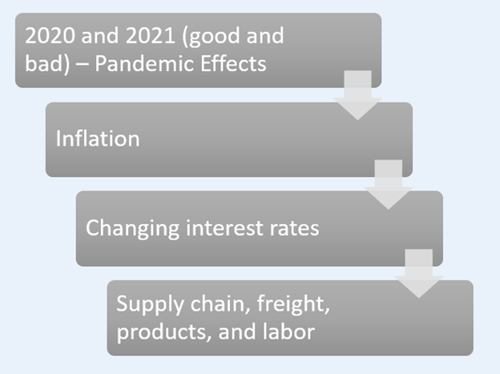

There are many economic and environmental factors that impact a valuation. These include the effects of the pandemic, inflation, changing interest rates, supply chain, and labor shortages.

The uniqueness of your business is a factor in the valuation process.

Some business owners are reluctant to raise prices to keep up with inflation, but that may mean they are operating at a loss, which will have a negative effect on their valuation. Managing costs and pricing is really important, considering valuations are based on the historical performance of the business.

Let's say you want to sell in two years, and when that valuation occurs, a historical look back shows a year of less profit. That will impact the future sales price. Managing costs and pricing now will help you with the future.

With the uncertainty of the supply chain, some businesses that may have in the past purchased a three-month supply of inventory may be purchasing a year's worth now.

That ensures they can meet consumer demand; however, that large purchase and inventory value will impact their financial statements. For those supplier businesses that are selling a year's worth of inventory at one time, they will show large sales one month and declining sales in future months.

All these factors need to be considered during the valuation process.

There are two types of buyers: corporate and private buyers.

A corporate buyer may be a private equity group that accumulates businesses in a similar industry. They purchase small-to-medium-sized businesses and then work to increase their value. By owning several businesses, they have more buying power and the ability to generate larger profits.

Private buyers are typically investors. It can be hard to compete with a corporate buyer, so the buy/sell market is seeing less private buyers currently.

Succession planning is a complex strategy where the business's value is just one component.

How you transition the business will impact the timing of your valuation. If you are selling outright, transferring to family, or gifting your business, it is imperative you have a current valuation. If you have shareholders, you have a fiduciary responsibility to increase the value of your business for maximum profit at the time of sale.

The succession of a business has many moving parts. Business interests will be allocated, the company's value determined, and many complex tax issues planned for.

As you put together your succession plan, you must include your financial and legal advisors and a qualified valuation professional.

When hiring a valuation expert, there are several factors to consider:

| Expertise | The valuation expert should have a strong understanding of the industry and the specific assets being valued. They should also be familiar with the various methods and approaches used in valuation. |

| Professional Qualifications | It's important to ensure that the valuation expert is properly qualified and has the necessary credentials. This may include certifications such as the ASA (Accredited Senior Appraiser) or ABV (Accredited in Business Valuation) designations. |

| Experience | Look for an expert who has a track record of successfully completing valuations in the relevant industry or asset class. |

| Independence | It's important that the valuation expert be independent and objective, with no conflicts of interest that could affect their work. |

| Communication Skills | The valuation expert should be able to clearly communicate their findings and reasoning to clients, as well as to other stakeholders such as attorneys or regulatory bodies. |

| Fees | Consider the valuation expert's fees and ensure they are reasonable and transparent. |

| References | It's always a good idea to ask for references and speak with past clients to get a sense of the expert's work and professionalism. |

Once you select your valuation expert, be open about your business as they are there to help you determine the value of your business and provide insights into things you may want to focus on before the sale.

© 2022 SVA Certified Public Accountants

Share this post:

Dan is a Principal with SVA Certified Public Accountants. He helps clients understand financial information to improve their company’s profitability and protect their interests. He does this by taking the time to understand the client, external influences and personal objectives of the owners. He works closely and proactively with the clients, emphasizing customer service and being available for his clients. This approach results in supporting clients with timely information and strategies to move them and their businesses forward to help them reach continued success.

Get Weekly Biz Tips Delivered Straight to Your Inbox!

Services

Madison, WI

1221 John Q Hammons Dr, Suite 100

Madison, WI 53717

(608) 831-8181

Milwaukee, WI

18650 W. Corporate Drive, Suite 200

Brookfield, WI 53045

(262) 641-6888

Colorado Springs, CO

10855 Hidden Pool Heights, Suite 340

Colorado Springs, CO 80908

(719) 413-5551

Are you in the know on the latest business trends, tips, strategies, and tax implications? SVA’s Biz Tips are quick reads on timely information sent to you as soon as they are published.

Copyright © 2026 SVA Certified Public Accountants | Privacy Policy | Cookie Policy | CCPA