| Highlights: |

- The article explains that under the new FASB lease accounting standard (ASC 842), most leases must now be recognized on the balance sheet as right-of-use assets and corresponding lease liabilities.

- It outlines how the change increases reported assets and liabilities versus prior rules and alters income statement treatment for operating versus finance leases.

- The post also defines right-of-use assets, lease liabilities, and basic criteria for leases, helping organizations begin assessing impacts on financial reporting.

|

On February 25, 2016, the Financial Accounting Standards Board (FASB) issued its new standard on accounting for leases.

(Download Video Transcript)

Under the new standard, a lessee is required to recognize most leases on its balance sheet, which is a significant change from today’s accounting requirements.

This standard is effective for nonpublic entities for periods beginning after December 15, 2021.

Impact to the Balance Sheet

There will be an increase in assets and liabilities on the balance sheet. Under the original standard, leases were classified as either capital leases or operating leases. While capital leases were recorded on a company’s balance sheet, operating leases were not.

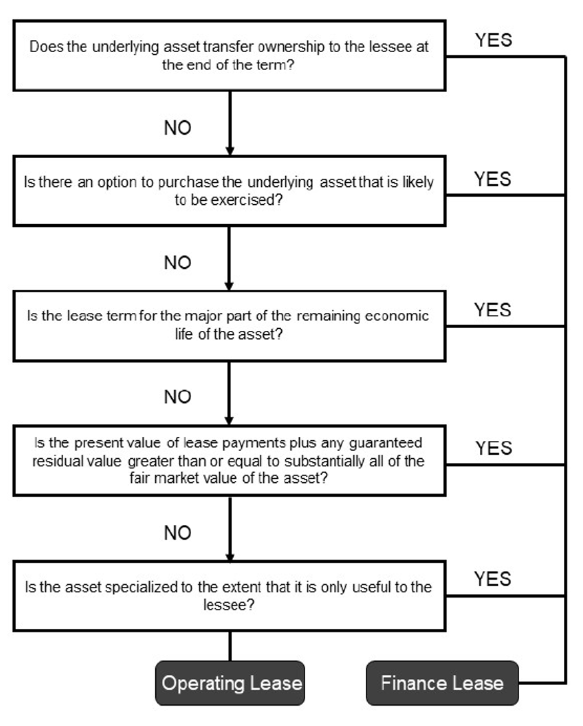

The new standard changes the types of classifications and the balance sheet treatment. Going forward, under the new standards, both classifications of leases, operating and finance, will be capitalized on the balance sheet.

There are a few exceptions, such as certain short-term leases less than or equal to 12 months in duration. However, in most cases, a right-of-use (ROU) asset will be recognized on the balance sheet along with a corresponding lease liability for the lease obligation.

Impact to the Income Statement

The treatment of operating and finance leases will differ on the income statement under the new standard.

For finance leases, the interest and amortization of the lease are presented separately on the income statement. However, for operating leases, the two are combined into a single line item.

With operating leases, a straight-line expense profile typically results. With finance leases, the expense profile is typically front-loaded due to the separate interest on the lease liability.

What are Right-of-Use Assets and Lease Liabilities?

Right-of-Use Asset

The right-of-use asset is valued as the initial amount of the lease liability plus any initial direct costs and lease payments made prior to the commencement date, minus lease incentives.

Lease Liability

The lease liability is calculated as the present value of the lease payments, using the discount rate specified in the lease, or if that is not available, the company’s Incremental Borrowing Rate (IBR).

To Qualify as Right-of-Use Asset, the Contract Must Meet 3 Criteria:

Identified Asset

There must be an identified asset. To qualify as identified, the asset must be physically distinct or the lessee must receive substantially all of the capacity of the asset. In addition, the lessor cannot have substantive rights to substitute the asset.

Economic Benefit

The lessee must receive substantially all of the economic benefits. To determine what qualifies as “substantially all,” the parties must define the economic benefits of the asset and then determine the allocation of economic benefits.

Direct the Use of Asset

The lessee must have the right to direct the use of the asset. If how the asset will be used was predetermined, the lessee must have the right to operate the asset or they must have designed the asset in a way that predetermines how it will be used.

For examples on how to calculate your leases, please click on the link below:

Download the Summary of the New Lease Accounting Standard PDF

© 2022 SVA Certified Public Accountants