What is the Fraud Triangle?

What is the Fraud Triangle?

The fraud triangle represents the factors that go into a person’s decision to commit fraud in the workplace. Developed by Dr. Donald Cressey, this model focuses on his research of people who were caught embezzling.

Most individuals who commit occupational fraud are not life-long criminals. For most, this is their first criminal act. What makes them suddenly commit a crime such as fraud? Let’s explore the three parts of the fraud triangle: Incentive, Opportunity, and Rationalization.

(Download Video Transcript)

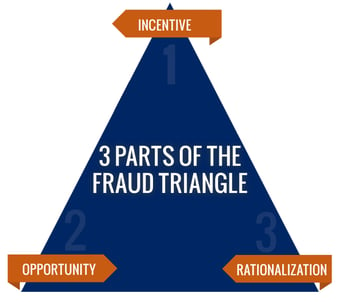

3 Parts of the Fraud Triangle

Dr. Cressey found in his research that all three components of the fraud triangle must be present for an ordinary person to commit fraud.

Incentive

The first leg of the triangle is the incentive or pressure to commit the crime.

What motivates a person to commit fraud? The person is looking for ways to solve their financial problems. Examples of financial issues include the inability to pay bills, having a drug or alcohol addiction, or wanting status, such as a bigger house or fancy car.

Opportunity

The second leg of the fraud triangle is the opportunity, also called perceived opportunity.

At this point, a person identifies ways to commit fraud with the lowest amount of risk. Here are a few examples of fraud opportunities:

- Lying about the number of hours worked, their sales numbers, or their productivity to receive higher pay

- Creating false invoices for products the company never purchased and pocketing the money

- Selling proprietary company information to competitors

Since maintaining social status is a common motivator in committing fraud, they must keep their crime a secret. Getting caught committing fraud to cover up their financial problems is just as bad as the financial problems themselves, so their method must be foolproof.

Rationalization

The third leg of the triangle is rationalization.

After identifying their motivating factors and opportunities to commit fraud, perpetrators must then rationalize that they are doing the right thing. Again, most first-time offenders don’t see themselves as criminals, just regular people caught in a bad situation. Examples of rationalizations are:

- They were “borrowing” the money

- They feel entitled to the money:

- Perceived low pay

- Worked long hours with no additional compensation

- Working at the company for many years and don’t feel respected or appreciated

- Just trying to pay their bills and provide for their family

Unfortunately, fraud is a common occurrence in business. It is difficult to stop all instances of fraud. Knowing the thought process behind those who commit these crimes may help companies implement strategies to reduce fraud in the future.

© 2021 SVA Certified Public Accountants