| Highlights: |

- Summarizes key insights on the purpose and structure of cash flow statements, emphasizing operating, investing, and financing cash movements.

- Explains how to analyze cash flow components to assess liquidity, financial health, and growth planning for business owners.

- Advises reviewing cash flow regularly alongside other financial reports to track performance and guide informed financial decisions.

|

Understanding your business’s cash flow is critical for making informed financial decisions and the statement of cash flows is the key tool that brings clarity to how money moves in and out of your operations.

This essential financial statement breaks down cash activity into operating, investing, and financing categories, helping business owners and financial professionals track liquidity, assess financial health, and plan for growth.

Explore five important insights about cash flow statements that every business owner should know.

(Download Video Transcript)

What is a Statement of Cash Flows?

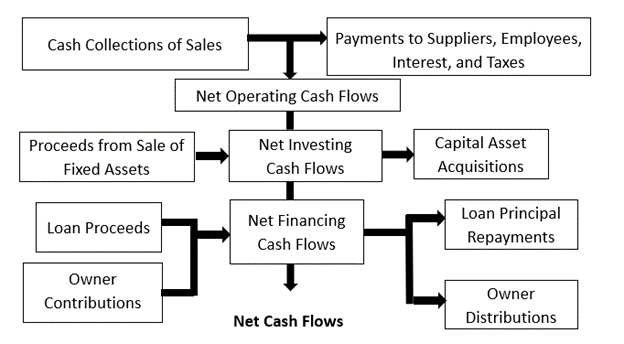

The statement of cash flows is one of the financial statements generated by a business that describes the cash flows used and provided by the business based on three types of activity -operating, investing, and financing during a specified period of time.

The purpose of cash flow statements is to show how cash is being generated and utilized throughout the business based on activities. This is important because we all know cash is KING.

Your income statement shows the profit of your business, but that profit might not necessarily be easily converted to cash.

What are the Three Components of a Cash Flow Statement?

Cash flow statements include cash from:

- Operating Activities

- Investing Activities

- Financing Activities

Operating Activities

When analyzing cash flow from operating activities, start with net income and adjust for transactions that affect operating activities but do not affect cash, for example, depreciation expense.

Then adjust for changes in balance sheet accounts that relate to operational activity. Lastly, perform an analysis of cash provided by or used in operating activities.

Investing Activities

Cash flow from investing activities involves long-term uses of your cash. These may include:

Financing Activities

Cash flow from financing activities gives insights into the financial strength and how well a company’s capital structure is managed. These may include:

- Proceeds from and repayment of debt (long-term, lines of credit)

- Capital contributions and distributions

Your cash from operating income should exceed your net income, as that positive cash flow indicates the ability to grow your operations. You may have negative cash flow if you are investing in future growth. The cash flow statement is just one of the financial statements to be reviewed each month.

If you need assistance developing your financial statement process or understanding what the numbers are telling you, give SVA a call. We can help you with all your financial reporting needs.

© 2022 SVA Certified Public Accountants