Whether you are a potential buyer or seller in a deal, it is essential that you understand all aspects of financial due diligence. With a comprehensive understanding of the issues at hand, you can more effectively navigate through your transaction and avoid unexpected bumps in the road.

Although often vital to the success of a deal, diligence surrounding a deal does not stop at the financial position and results of a target. A buyer should consider a wide array of other potential issues to ensure that the proper level of diligence is completed.

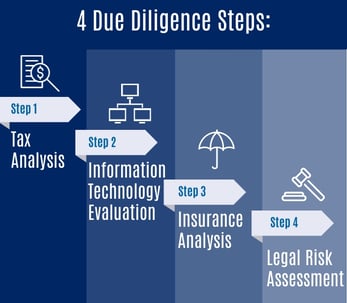

4 Common Due Diligence Engagements

Some of the most common diligence engagements performed by buyers and their advisors during the deal process may include:

Taxes

Analysis and review of the many different types of taxes that may be imposed by various taxing jurisdictions on a target is crucial to understanding not only the post-transaction after-tax cash flow of the target, but also any potential tax obligations that may flow to the buyer as a result of the transaction.

Tax due diligence commonly includes a review of income (federal, state, and local), sales and use, payroll, employment, and property taxes, among others. This assists the buyer in understanding the tax landscape of the target and ensures the target is in compliance with all tax-related matters. If a buyer fails to check all the tax-related boxes, they may find themselves subject to unwanted and/or unforeseen tax-related liabilities.

Information Technology

This diligence includes reviewing, analyzing, and evaluating the information technology (IT) function of a potential target. This engagement may involve an extensive examination of the target’s technological architecture, processes, products, and assets.

IT diligence allows the buyer to gain comfort with the target’s current IT capabilities, the complexity of its IT architecture, and sustainability of its IT assets. Without a clear understanding of a target’s IT department and infrastructure, the buyer may need to make meaningful and unexpected capital expenditures post-transaction.

Insurance

Insurance diligence assists in identifying the target’s current insurance policies and whom the policies fall under, current premiums discounts, historical losses, existing liabilities or undisclosed liabilities, potential exposures, and the transferability of these policies post-transaction.

Too often, buyers overlook insurance diligence and analysis of insurance-related matters during a proposed transaction. It is important for the buyer to fully understand the current state of the target’s insurance programs. Not doing so can lead to unwanted risk and exposure post-transaction.

Legal

In order for a buyer to better understand the target, the buyer may engage legal counsel to assess the legal risks associated with a potential acquisition.

Review of all corporate and legal documentation allows the buyer and their legal counsel to identify any potential legal problems that could result from the proposed transaction (or that the buyer may inherit from the seller as a result of the transaction). If this is not properly completed, the closing of a deal can be delayed, or worse, terminated.

SVA Certified Public Accountants assists clients in a wide variety of diligence capacities. Whether it’s performing financial or tax diligence or you need help finding a qualified attorney or other specialist, SVA has the resources to ensure you can navigate smoothly through your deal to closing.

© 2021 CPA ContentPlus