Accounting accuracy is a requirement for every business as it measures the company's financial health. You likely have accounting processes and procedures you are comfortable with. But are they the best they can be? Let's start by discussing how that data process works and why it is essential.

(Download Video Transcript)

What is the Accounting Cycle?

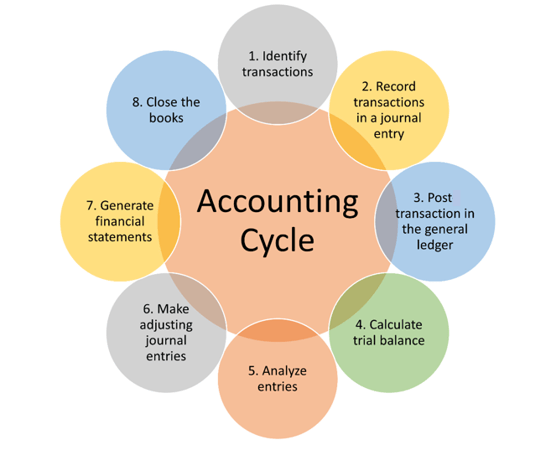

The accounting cycle is the process of opening and closing the books over a specific period, typically monthly. The eight-step process begins with recording all financial transactions and ends with reporting the results for the designated cycle timeframe. The steps are:

Your accounting software can automate some of the processes, giving your management team consistent monthly, quarterly, and yearly reports.

Why are Financial Statements Important?

Financial statements measure your business's overall health, enabling you to review past, current, and projected performance. Financial statements include:

- The balance sheet reports company assets, liabilities, shareholder equity, and the company's financial book value.

- The income statement compares expenses to revenue and shows the net profit or loss for the determined period of time.

- The cash flow statement shows the cash flow from operating, investing, and financing activities.

These statements are used to inform decisions on performance and value.

How Do I Analyze Financial Data?

Financial analysis includes generating a set of ratios and comparing those ratios over time to determine areas that are working well or where improvements may be needed. The ratios you benchmark should be chosen based on your industry and specific business needs. Some common ratios are:

- Profit Margin Ratio = Net Income divided by Net Sales

- Profitability Ratio = Operating Profit Before Tax divided by Total Income

- Debt/Equity Ratio = Total Liabilities divided by Shareholder Equity

- Working Capital Ratio = Current Assets divided by Current Liabilities

- Inventory Turnover Ratio = Cost of Goods Sold divided by Average Inventory

- Gross Margin Ratio = (Revenue less Cost of Goods Sold) divided by Revenue

Work with your accounting advisor to determine the ratios you should benchmark against. They can provide industry comparisons and guide you through using those ratios to meet your business goals.

How Do I Ensure My Accounting Processes are Efficient, Effective, and Accurate?

As you know, financial data and how it is collected and processed is extremely important. As your business grows, there is a point when you should review your processes by looking at ways to generate efficiencies and streamline workflows.

Over time it is easy to become comfortable with functions, leading to stagnant procedures and disconnected data. An outside advisor with experience in financial reporting can perform the review for the business.

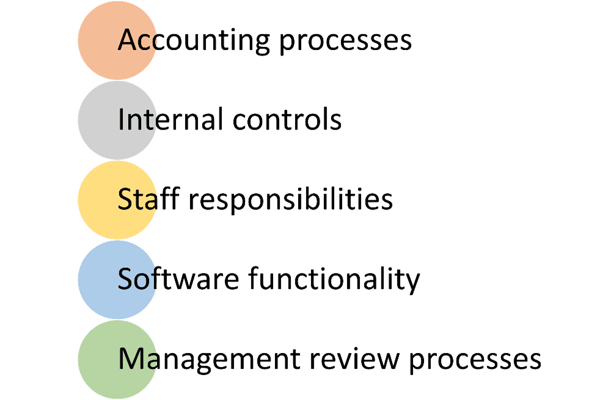

An Internal Accounting Procedure Review Will Include Reviewing Your:

After an extensive review, your advisor will outline efficiencies and opportunities and work with you to determine the next steps.

SVA Has the Expertise You Need

Our SVA team focuses on the importance of your financial data and can complete a hands-on analysis of your business's financial reporting. With every analysis, we document processes, efficiencies, and ultimately opportunities. With expertise in financial reporting software, we often uncover ways to automate processes, which leads to increased accuracy and staff time savings.

With staffing a continued issue for many business owners, effectively utilizing your existing staff resources is extremely important. Give us a call and let's chat about your financial reporting processes.

© 2022 SVA Certified Public Accountants