Stay on top of the most sweeping tax legislation in recent years - the One Big Beautiful Bill Act (OBBA). Our latest eGuide breaks down how this legislation affects both individuals and businesses, providing a side-by-side comparison in a clear, easy-to-scan format.

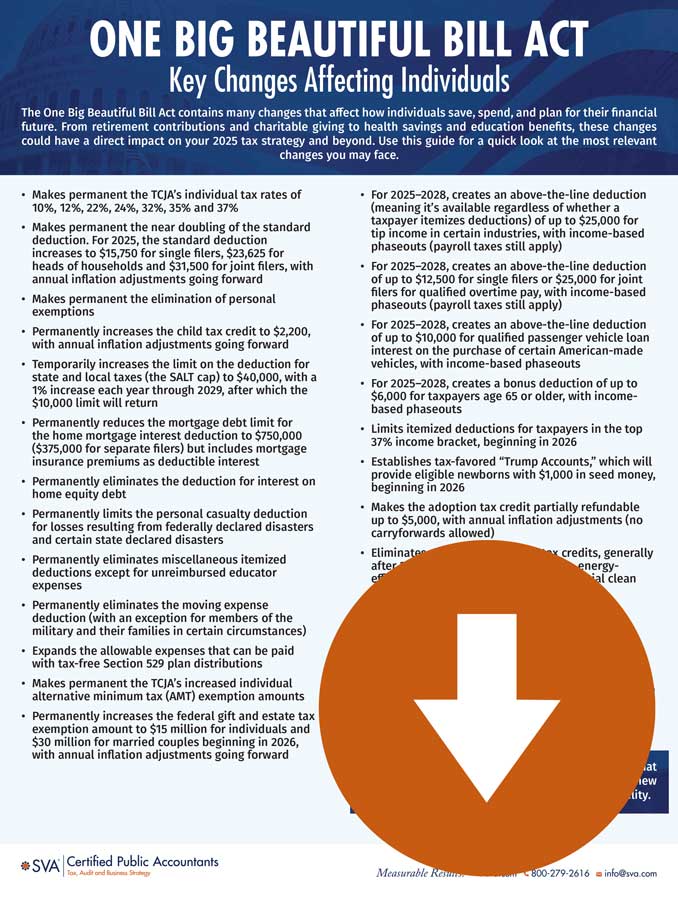

Page 1: Changes for Individuals

- Updated income tax brackets, credits, and deductions

- New above-the-line deductions for tip income, overtime, and vehicle loan interest

- Permanent changes to retirement, education, and estate planning

- Elimination or restriction of multiple green energy and itemized deductions

Page 2: Changes for Businesses

- Permanent 20% QBI deduction and 100% bonus depreciation

- Increased Sec. 179 expensing and business interest limits

- Elimination of commercial energy incentives

- Expanded credits for child care and paid leave

- Modifications to international tax provisions